Should I be Investing in Crypto? An Analysis on Future Applications of DeFi

Within the last few years this question has loomed over every

investor’s head and is the topic of heavy discourse within every financial industry. This question

has been enflamed over the last few years because of the seemingly endless number of “Crypto Billionaires”

that have surfaced, indicating the possibility of lost revenue for those not invested. Like many things

in life, it seemed too good to be true and while the returns were enticing, the risk was overwhelming

for many financial firms and investors. So, the question becomes is the current growth sustainable and

why is crypto so risky?

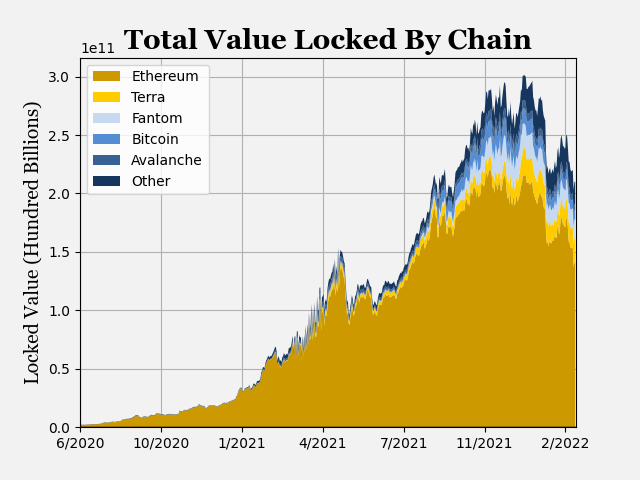

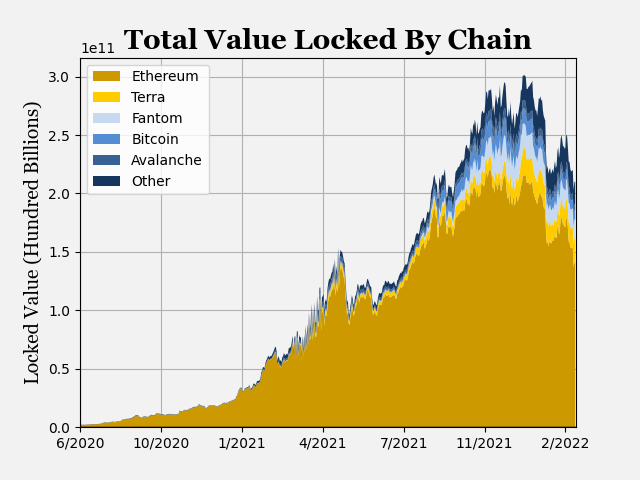

While this question could be debated until the end of time it is important to discuss some of the underlying factors for crypto’s current success. The first of which, which is by far the most important, financial system adoption. The complete adoption of cryptocurrency in the financial system would necessitate its permanent success. This is because it would no longer be the trendy investment with enormous risk and an almost cult-like following and would become theoretically as stable as any other currency. This adoption of crypto in the financial system would not only make returns more sustainable but would open the door to massive amounts of innovation in the financial system. This adoption is already being observed by a measure called Total Value Locked (TVL) which is a measure of the total value of crypto assets. Charted in Figure 1 is TVL separated by blockchain.

Source: DeFiLlama, Data as of February 20th, 2022

This chart illustrates a few characteristics about the current state of crypto as a whole. First and most obvious, is that Ethereum is by far the largest competitor in this space, and this is because of its very user friendly and adaptable programming. The second is that there appears to be a somewhat significant decline in the total TVL since the end of last year. This can be attributed to the fact that this is a measure of asset value meaning it is sensitive to price fluctuations and since the end of last year many crypto prices have fallen considerably.

The most important takeaway from this chart however is the significant, almost exponential, increase in the total value. This increase shows that this is more than just a get rich quick scheme since at its peak, roughly 300 billion dollars, it was roughly equivalent to 5% of all US Government assets, and 0.2% of all financial assets in the US. This increase is also followed by an increasing diversification of the type of chain used which will give rise to even more sustainable returns that investors are searching for. So, where is this nearly 300 billion dollars in cryptocurrency and what is it used for?

Source: DeFiLlama, Data as of February 20th, 2022

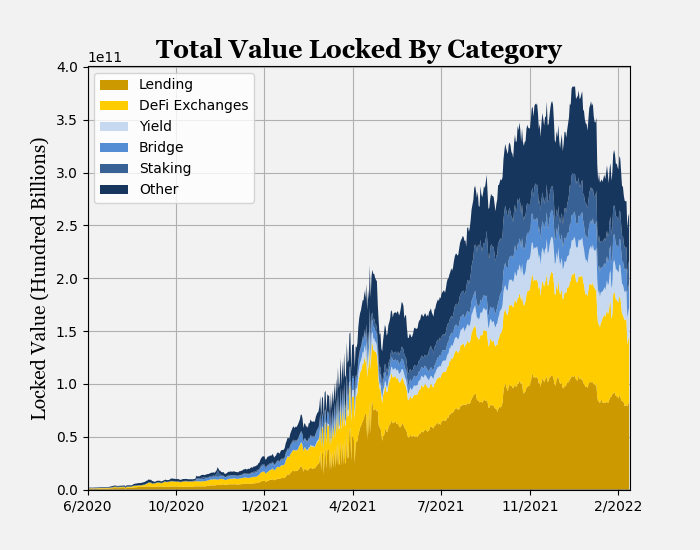

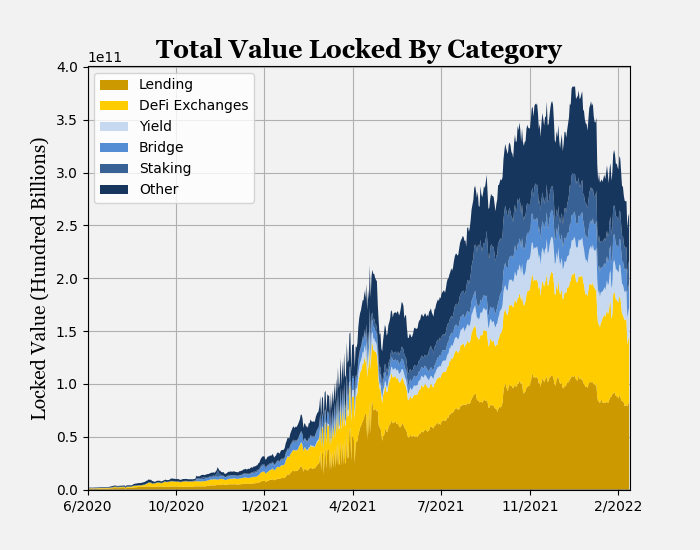

Charted in Figure 2 is the same TVL dataset but separated by usage category, and while this may look very

similar the chart before it provides a very different point of view. This chart shows that the largest

category of usage, which is unsurprising considering it is the backbone of the financial system, is

lending. The second largest category is DeFi Exchanges which essentially acts like cash in the financial

system and is the currency that is used to trade, buy, and sell anything digital currency. The other

smaller categories of this chart deal more with creating yield for investors and exchanging and creating

currencies.

This chart not only shows how diverse the TVL is but also shows how similar it is becoming to the current financial system, which in time could mean it mirrors it exactly. So, if crypto is becoming so similar to the current financial system and there are massive amounts of investment flooding the space, why are investors and financial firms so hesitant?

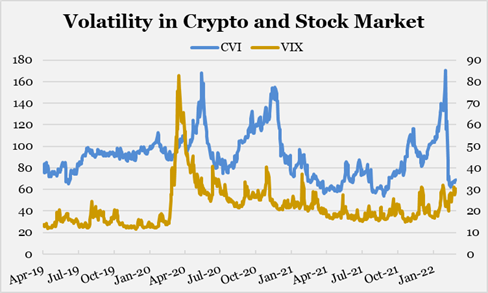

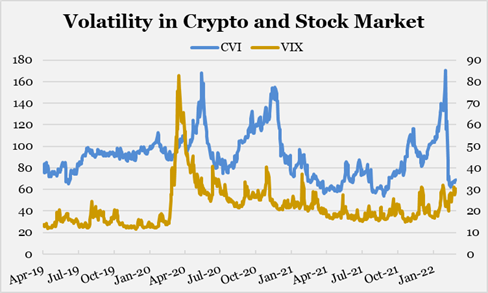

One of the biggest concerns for investors is volatility, which creates additional risk for investors beyond valuation concerns. Charted in Figure 3 are two measures for volatility, the first of which is much more commonly used and is the Volatility Index (VIX) which measures volatility in the Stock Market. The second and much less common is the Crypto Volatility Index (CVI) which acts just like the VIX but measures the volatility for the largest cryptocurrencies. This chart highlights a few meaningful points, showing that although the VIX has a much larger spike at the start of the pandemic the CVI has much more frequent spikes. Crypto’s volatility, which is less predictable and much less deterministic is what drives many investors to look elsewhere for returns.

Source: CBOE, COTI; Data as of February 20th,2022

Source: CBOE, COTI; Data as of February 20th,2022

As opposed to the VIX, the CVI can spike for close to no reason at all, and because of how easy it is to transact on crypto platforms and 24/7 market hours spikes can happen in a matter of hours and won’t stop until the market recovers. This once again is an enormous red flag for traditional investors used to having someone on the control panel at all times ready to shut it all down at the slightest hint of unusual trading. Cryptocurrencies are a double edged sword to investors because its innovative decentralized nature entices investors but it is the lack of control that drives away the very same investors. Despite the massive amounts of information and varied sentiments on cryptocurrency one thing is blatantly clear, crypto is here to stay. Although it may not be the most conservative investment approach, there exists tremendous opportunity. As more currencies are made and more regulation is unfolded these discussions will focus less on adoption and more on growth, and only then will investors turn their heads and begin to give it a second look. Until then, it will remain a trendy pipedream for the irrational day traders and absurdly wealthy to make more money off of.

While this question could be debated until the end of time it is important to discuss some of the underlying factors for crypto’s current success. The first of which, which is by far the most important, financial system adoption. The complete adoption of cryptocurrency in the financial system would necessitate its permanent success. This is because it would no longer be the trendy investment with enormous risk and an almost cult-like following and would become theoretically as stable as any other currency. This adoption of crypto in the financial system would not only make returns more sustainable but would open the door to massive amounts of innovation in the financial system. This adoption is already being observed by a measure called Total Value Locked (TVL) which is a measure of the total value of crypto assets. Charted in Figure 1 is TVL separated by blockchain.

Figure 1

Source: DeFiLlama, Data as of February 20th, 2022

This chart illustrates a few characteristics about the current state of crypto as a whole. First and most obvious, is that Ethereum is by far the largest competitor in this space, and this is because of its very user friendly and adaptable programming. The second is that there appears to be a somewhat significant decline in the total TVL since the end of last year. This can be attributed to the fact that this is a measure of asset value meaning it is sensitive to price fluctuations and since the end of last year many crypto prices have fallen considerably.

The most important takeaway from this chart however is the significant, almost exponential, increase in the total value. This increase shows that this is more than just a get rich quick scheme since at its peak, roughly 300 billion dollars, it was roughly equivalent to 5% of all US Government assets, and 0.2% of all financial assets in the US. This increase is also followed by an increasing diversification of the type of chain used which will give rise to even more sustainable returns that investors are searching for. So, where is this nearly 300 billion dollars in cryptocurrency and what is it used for?

Figure 2

Source: DeFiLlama, Data as of February 20th, 2022

This chart not only shows how diverse the TVL is but also shows how similar it is becoming to the current financial system, which in time could mean it mirrors it exactly. So, if crypto is becoming so similar to the current financial system and there are massive amounts of investment flooding the space, why are investors and financial firms so hesitant?

One of the biggest concerns for investors is volatility, which creates additional risk for investors beyond valuation concerns. Charted in Figure 3 are two measures for volatility, the first of which is much more commonly used and is the Volatility Index (VIX) which measures volatility in the Stock Market. The second and much less common is the Crypto Volatility Index (CVI) which acts just like the VIX but measures the volatility for the largest cryptocurrencies. This chart highlights a few meaningful points, showing that although the VIX has a much larger spike at the start of the pandemic the CVI has much more frequent spikes. Crypto’s volatility, which is less predictable and much less deterministic is what drives many investors to look elsewhere for returns.

Figure 3

Source: CBOE, COTI; Data as of February 20th,2022

Source: CBOE, COTI; Data as of February 20th,2022

As opposed to the VIX, the CVI can spike for close to no reason at all, and because of how easy it is to transact on crypto platforms and 24/7 market hours spikes can happen in a matter of hours and won’t stop until the market recovers. This once again is an enormous red flag for traditional investors used to having someone on the control panel at all times ready to shut it all down at the slightest hint of unusual trading. Cryptocurrencies are a double edged sword to investors because its innovative decentralized nature entices investors but it is the lack of control that drives away the very same investors. Despite the massive amounts of information and varied sentiments on cryptocurrency one thing is blatantly clear, crypto is here to stay. Although it may not be the most conservative investment approach, there exists tremendous opportunity. As more currencies are made and more regulation is unfolded these discussions will focus less on adoption and more on growth, and only then will investors turn their heads and begin to give it a second look. Until then, it will remain a trendy pipedream for the irrational day traders and absurdly wealthy to make more money off of.

Disclosures:

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Past performance is not a guarantee of future results.

Asset allocation/diversification does not guarantee a profit or protection against loss.

The Bureau of Economic & Asset Research at Berkeley does not provide tax, legal or accounting advice. Information presented is not intended to provide, and should not be relied on for tax, legal and accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction.

The price of equity securities may rise or fall due to the changes in the broad market or changes in a company's financial condition, sometimes rapidly or unpredictably. Equity securities are subject to 'stock market risk' meaning that stock prices in general may decline over short or extended periods of time.

When investing in mutual funds or exchange traded funds, please consider the investment objectives, risks, charges, and expenses associated with the funds. The prospectus contains this and other information, which should be carefully read before investing. You may obtain a fund's prospectus by visiting the fund company's website.

All companies referenced are shown for illustrative purposes only and are not intended as a recommendation or endorsement by the Bureau of Economic & Asset Research at Berkeley in this context.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Past performance is not a guarantee of future results.

Asset allocation/diversification does not guarantee a profit or protection against loss.

The Bureau of Economic & Asset Research at Berkeley does not provide tax, legal or accounting advice. Information presented is not intended to provide, and should not be relied on for tax, legal and accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction.

The price of equity securities may rise or fall due to the changes in the broad market or changes in a company's financial condition, sometimes rapidly or unpredictably. Equity securities are subject to 'stock market risk' meaning that stock prices in general may decline over short or extended periods of time.

When investing in mutual funds or exchange traded funds, please consider the investment objectives, risks, charges, and expenses associated with the funds. The prospectus contains this and other information, which should be carefully read before investing. You may obtain a fund's prospectus by visiting the fund company's website.

All companies referenced are shown for illustrative purposes only and are not intended as a recommendation or endorsement by the Bureau of Economic & Asset Research at Berkeley in this context.